Niche Markets Prove Opening To Windows of Opportunity

Jun 25, 2004 Ι Industry News Ι Furniture Ι By Ben, CENS

Manufacturers of office furniture in Taiwan are marrying their long-term experience in flexible small-batch production to a new emphasis on multifunctional products of sophisticated design, producing a winning formula that is gaining attention from buyers serving upscale markets.

Local producers are also wooing younger fashion-conscious buyers with the use of multiple materials and advanced-concept designs.

The shift to more lucrative upper-end niche markets comes at a time when Taiwan is increasingly under the gun from mainland Chinese rivals in lower-end market sergments. In fact, many producers on the island have moved their plants across the Taiwan Strait to China in the past two decades to take advantage of the same low land and labor costs that are helping mainland producers pry away markets once well under Taiwan's control.

For wood furniture makers, however, the move to mainland China has brought new problems even as the old one of high costs is resolved. The biggest of these headaches is the looming threat of anti-dumping tariffs on wood furniture exports from the mainland to the U.S. Although the dumping charge is now focused on wooden bedroom furniture, manufacturers producing in the mainland worry that the scope of the anti-dumping measures could be expanded to other kinds of wooden furniture.

Moving Up, Not Away

Chueng Shine Co., Ltd. Is one of the few professional manufacturers of office chairs that has stayed rooted in Taiwan. The company concentrates on innovative and functional products to avoid price competition from such developing nations as mainland China and some Southeast Asian nations.

Founded as a hardware processor in 1981, Chueng Shine transformed itself into a manufacturer of office chairs in 1988.

Today the company has an integrated production line, which can handle all of the important manufacturing processes in-house, including steel shearing, processing and forming. In consideration of environmental protection requirements, the company commissions the high pollution production process of electroplating and paint spraying to specialized firms.

Environment-protection concerns extend to the types of materials used at Chueng Shine. "All of our products are recyclable in accord with the environmental protection regulations adopted in many industrialized nations," says company president Lu Wu-chin. "For instance, we adopt environment-friendly PP (polypropylene) to replace toxic PVC (polyvinyl carbonate) and reduce the use of Formalin in our wood sheets. We have also enhanced the structure of our products with the help of specially designed mechanisms to ensure product durability."

At present, Chueng Shine exports half of its output to Japan with the remainder going to Europe, the U.S., the Middle East and Africa. "Japan is a critical market and demands high-quality products. Our concentration on that market proves that the quality of our products is reliable," says Lu.

To keep its quality standards high, Chueng Shine has invested in sophisticated inspection equipment and automated production equipment over the past few years. The company currently has four welding robotic arms, six computerized numerically controlled pipe-bending machines, 30 pressing machines, and inspection instruments to test torque, loading, durability, strength and pressure.

By focusing on high-quality office chairs, Chueng Shine has been able to remain competitive in Taiwan, unlike many of the company's industry counterparts that have headed to mainland China. "Taiwan is an ideal place for the production of high-quality office furniture because of the ample supply of skilled technicians and R&D personnel here," says Lu.

Chueng Shine currently has four R&D specialists in charge of product development. Lu says his company spends over NT$10 million (US$300,000 at US$1:NT$33.5) on R&D each year.

Lu says his company is capable of developing innovative office chairs faster than his industry rivals. "We have accumulated a lot of experience in developing special mechanisms and innovative products." This ability, he says, enables his firm to continually turn out new items and keep a few steps ahead of copycats. Lu is also confident that his company's advanced chair mechanisms are beyond the ability of copycats to reproduce.

Cheung Shine has obtained many design patents in Japan, the U.S. and Europe. At present, most of the company's products are made on an own-design basis. Only 15% of total output is made on OEM terms.

In March, the company introduced a new executive chair, which also fits the needs of SOHO (small office, home office) workers. The company says it spent eight months to develop the sophisticated chair, which has a patented adjustable rear waist support and adjustable seat and arms. The five-claw chair leg with castors is electroplated.

Cheung Shine displays its products at major international furniture shows held in Cologne of Germany, Chicago of the U.S., Dubai of the United Arab Emirates, and Kuala Lumpur of Malaysia. The company claims that these shows have helped it win new customers. It is now aggressively tapping the U.S. market.

Anti-Dumping Threat

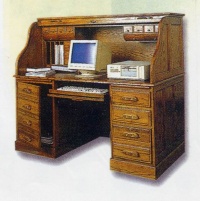

Thanks to its successful penetration of the U.S. market over the past few years, Kee Jia Wood Co., Ltd. Has been one of Taiwan's leading manufacturers of American-style wood furniture.

Lin Wen-pin, president of Kee Jia, says his company has been producing wooden furniture for over 20 years. To facilitate the influx of foreign orders, some 12 years ago the company moved most of its production capacity to mainland China and redefined its Taiwan facility as an operating center. The company says it imports high-quality wood materials from the U.S., Belgium, and Malaysia to facilitate mainland production.

Kee Jia currently operates two plants in Guangdong province of mainland China. One of them focuses on the production of small items, such as TV cabinets and office furniture, and the other is used in producing wooden bedroom furniture sets.

Recently, the company bought a large site next to its original plant to accommodate future expansions. "We planned to expand our production facilities by the end of this year," says Lin. "But we have put the project on hold due to the threat of anti-dumping measures by the U.S. against mainland furniture manufacturers."

At present, Kee Jia uses 40% of its production capacity for bedroom furniture, another 40% for the production of office furniture, and the remainder for dining sets and small items. All of the company's products are made of wood.

The company currently exports 90% of its output to the U.S. with the remainder going to other overseas markets. "Since the inception of our company we have been focusing on the American-style furniture," notes Lin. "In the past year, bedroom sets have been our fastest growing product line. So we will be deeply impacted if the U.S. imposes too high import duties on our products in the wake of the dumping investigation."

Faced by the threat of anti-dumping measures, Lin's company is considering diversifying its export outlets to reduce its dependence on the U.S. market. The company is currently mapping out a plan to develop the European Union market.

To develop the new EU market, Kee Jia is developing European-style office furniture. "In the past, we focused exclusively on American-style office furniture," explains Lin. "In the future, we will shift some capacity to products aimed at the European market."

Despite the threat of dumping charges, the company saw an influx of orders from the U.S. in the first quarter of this year. "Most of the orders will be fulfilled by the end of May," says Lin. "But our U.S. buyers are hesitant to place more orders for shipment after June because of the threat of the anti-dumping action."

Kee Jia currently is capable of shipping 900 40-foot containers per month. With the recent completion of two new production lines at its second plant in mainland China, the company will be able to ship 1,400 containers per month from the third quarter of this year.

Lin says that additional expansions may come in the future, noting that the company's profitable affiliates in Taiwan have the financial muscle to back new investment in increased furniture output.

Contact information on companies covered by the article:

Chueng Shine Co., Ltd.

Address: No.198-6, Chintan Li, Taipao, Chiayi Hsien, Taiwan

Tel: 886-5-371-3928

Fax: 86-5-371-5528

E-mail:cschair@ms55.hinet.net

Website://www.cschair.com

Kia Jia Wood Co., Ltd.

Address: No.20, Tafu Rd., Sec.3, Tantze Hsiang, Taichung, Taiwan

Tel: 886-4-2532-7841

Fax: 886-4-2532-4340

E-mail: keejia@ms11.hinet.net

Website://www.techlanewood.com

Local producers are also wooing younger fashion-conscious buyers with the use of multiple materials and advanced-concept designs.

The shift to more lucrative upper-end niche markets comes at a time when Taiwan is increasingly under the gun from mainland Chinese rivals in lower-end market sergments. In fact, many producers on the island have moved their plants across the Taiwan Strait to China in the past two decades to take advantage of the same low land and labor costs that are helping mainland producers pry away markets once well under Taiwan's control.

For wood furniture makers, however, the move to mainland China has brought new problems even as the old one of high costs is resolved. The biggest of these headaches is the looming threat of anti-dumping tariffs on wood furniture exports from the mainland to the U.S. Although the dumping charge is now focused on wooden bedroom furniture, manufacturers producing in the mainland worry that the scope of the anti-dumping measures could be expanded to other kinds of wooden furniture.

Moving Up, Not Away

Chueng Shine Co., Ltd. Is one of the few professional manufacturers of office chairs that has stayed rooted in Taiwan. The company concentrates on innovative and functional products to avoid price competition from such developing nations as mainland China and some Southeast Asian nations.

Founded as a hardware processor in 1981, Chueng Shine transformed itself into a manufacturer of office chairs in 1988.

Today the company has an integrated production line, which can handle all of the important manufacturing processes in-house, including steel shearing, processing and forming. In consideration of environmental protection requirements, the company commissions the high pollution production process of electroplating and paint spraying to specialized firms.

Environment-protection concerns extend to the types of materials used at Chueng Shine. "All of our products are recyclable in accord with the environmental protection regulations adopted in many industrialized nations," says company president Lu Wu-chin. "For instance, we adopt environment-friendly PP (polypropylene) to replace toxic PVC (polyvinyl carbonate) and reduce the use of Formalin in our wood sheets. We have also enhanced the structure of our products with the help of specially designed mechanisms to ensure product durability."

At present, Chueng Shine exports half of its output to Japan with the remainder going to Europe, the U.S., the Middle East and Africa. "Japan is a critical market and demands high-quality products. Our concentration on that market proves that the quality of our products is reliable," says Lu.

To keep its quality standards high, Chueng Shine has invested in sophisticated inspection equipment and automated production equipment over the past few years. The company currently has four welding robotic arms, six computerized numerically controlled pipe-bending machines, 30 pressing machines, and inspection instruments to test torque, loading, durability, strength and pressure.

By focusing on high-quality office chairs, Chueng Shine has been able to remain competitive in Taiwan, unlike many of the company's industry counterparts that have headed to mainland China. "Taiwan is an ideal place for the production of high-quality office furniture because of the ample supply of skilled technicians and R&D personnel here," says Lu.

Chueng Shine currently has four R&D specialists in charge of product development. Lu says his company spends over NT$10 million (US$300,000 at US$1:NT$33.5) on R&D each year.

Lu says his company is capable of developing innovative office chairs faster than his industry rivals. "We have accumulated a lot of experience in developing special mechanisms and innovative products." This ability, he says, enables his firm to continually turn out new items and keep a few steps ahead of copycats. Lu is also confident that his company's advanced chair mechanisms are beyond the ability of copycats to reproduce.

Cheung Shine has obtained many design patents in Japan, the U.S. and Europe. At present, most of the company's products are made on an own-design basis. Only 15% of total output is made on OEM terms.

In March, the company introduced a new executive chair, which also fits the needs of SOHO (small office, home office) workers. The company says it spent eight months to develop the sophisticated chair, which has a patented adjustable rear waist support and adjustable seat and arms. The five-claw chair leg with castors is electroplated.

Cheung Shine displays its products at major international furniture shows held in Cologne of Germany, Chicago of the U.S., Dubai of the United Arab Emirates, and Kuala Lumpur of Malaysia. The company claims that these shows have helped it win new customers. It is now aggressively tapping the U.S. market.

Anti-Dumping Threat

Thanks to its successful penetration of the U.S. market over the past few years, Kee Jia Wood Co., Ltd. Has been one of Taiwan's leading manufacturers of American-style wood furniture.

Lin Wen-pin, president of Kee Jia, says his company has been producing wooden furniture for over 20 years. To facilitate the influx of foreign orders, some 12 years ago the company moved most of its production capacity to mainland China and redefined its Taiwan facility as an operating center. The company says it imports high-quality wood materials from the U.S., Belgium, and Malaysia to facilitate mainland production.

Kee Jia currently operates two plants in Guangdong province of mainland China. One of them focuses on the production of small items, such as TV cabinets and office furniture, and the other is used in producing wooden bedroom furniture sets.

Recently, the company bought a large site next to its original plant to accommodate future expansions. "We planned to expand our production facilities by the end of this year," says Lin. "But we have put the project on hold due to the threat of anti-dumping measures by the U.S. against mainland furniture manufacturers."

At present, Kee Jia uses 40% of its production capacity for bedroom furniture, another 40% for the production of office furniture, and the remainder for dining sets and small items. All of the company's products are made of wood.

The company currently exports 90% of its output to the U.S. with the remainder going to other overseas markets. "Since the inception of our company we have been focusing on the American-style furniture," notes Lin. "In the past year, bedroom sets have been our fastest growing product line. So we will be deeply impacted if the U.S. imposes too high import duties on our products in the wake of the dumping investigation."

Faced by the threat of anti-dumping measures, Lin's company is considering diversifying its export outlets to reduce its dependence on the U.S. market. The company is currently mapping out a plan to develop the European Union market.

To develop the new EU market, Kee Jia is developing European-style office furniture. "In the past, we focused exclusively on American-style office furniture," explains Lin. "In the future, we will shift some capacity to products aimed at the European market."

Despite the threat of dumping charges, the company saw an influx of orders from the U.S. in the first quarter of this year. "Most of the orders will be fulfilled by the end of May," says Lin. "But our U.S. buyers are hesitant to place more orders for shipment after June because of the threat of the anti-dumping action."

Kee Jia currently is capable of shipping 900 40-foot containers per month. With the recent completion of two new production lines at its second plant in mainland China, the company will be able to ship 1,400 containers per month from the third quarter of this year.

Lin says that additional expansions may come in the future, noting that the company's profitable affiliates in Taiwan have the financial muscle to back new investment in increased furniture output.

Contact information on companies covered by the article:

Chueng Shine Co., Ltd.

Address: No.198-6, Chintan Li, Taipao, Chiayi Hsien, Taiwan

Tel: 886-5-371-3928

Fax: 86-5-371-5528

E-mail:cschair@ms55.hinet.net

Website://www.cschair.com

Kia Jia Wood Co., Ltd.

Address: No.20, Tafu Rd., Sec.3, Tantze Hsiang, Taichung, Taiwan

Tel: 886-4-2532-7841

Fax: 886-4-2532-4340

E-mail: keejia@ms11.hinet.net

Website://www.techlanewood.com

©1995-2006 Copyright China Economic News Service All Rights Reserved.