Taiwan PTW Parts Makers Roll Fast Forward

May 20, 2005 Ι Industry News Ι Auto Parts and Accessories Ι By Quincy, CENS

Taiwan is quickly building a name as one of the world's top suppliers of parts for powered two-wheelers (PTWs) and all-terrain vehicles (ATVs), thanks to the high product quality and reasonable pricing it brings to the table.

Nevertheless, it has not all been easy sailing for local players. PTW-parts makers on the island today face a two-pronged threat--in the high-end market from rivals in industrially advanced countries and in the mass-market segment from competitors in low-cost countries, especially mainland China and nations in Southeast Asia.

Many local firms have responded to the intensifying competition by pouring more resources into R&D and manufacturing-process improvements in an effort to further pare costs while enhancing quality.

These efforts have helped make Taiwan a supplier of choice for the growing number of PTW brands in Japan and Europe that have been outsourcing parts production to cut costs.

Taiwan itself produces about 1.2 to 1.4 million PTWs each year. Increasingly, however, producers are seeking to expand overseas sales to offset the stagnant growth being experienced in the heavily saturated domestic market. In the past five years many local PTW makers have set up overseas plants to tap major markets, and local PTW-parts makers have followed suit to supply not only their expatriated compatriots but also new local customers in such quickly expanding markets as Indonesia, India, mainland China, and Vietnam.

Still, many PTW-parts manufacturers have chosen to maintain part or all of their production capacity in Taiwan, honing their competitive edge with highly automated and flexible production lines and innovative cost-cutting measures, such as using a high ratio of standardized components in their products.

High-Precision Parts

One example is An-Lin Technology Industrial Co., Ltd., which supplies high-precision CMC lathe-processed parts and components to all major PTW and ATV makers as well many leading auto-parts makers in Taiwan. An-Lin is an ISO 9001 certified company and is scheduled to win the ISO/TS-16949 quality certification this year.

An-Lin sales manager Chang Chin-chiung says his company now supplies a wide range of precision parts to the transportation-equipment line, including automobile water-pump shafts and thermostat pins (auto parts currently account for 20% of the company's sales); and piston pins, oil-pump shafts, carburetor parts (throttle valves, nozzles, jet needles, etc.), collars and bushings for PTW and ATV frames and engines (80%). The company plays a key role in the local PTW/ATV line as it supplies products to most leading makers and tier-one parts suppliers.

According to Chang, An-Lin has been focusing on auto and PTW parts since its establishment 20 years ago and it has garnered a lot of experience in that time. The company develops dies and produces own CNC lathes. Heat-treatment and grinding work are contracted out to satellite plants with long ties to the company.

An-Lin's core competitiveness, Chang stresses, lies in the company's price, quality, and on-time delivery, which, he claims, is unmatched among the company's local industry peers. "An-Lin now owns 50 CNC lathes, all of which are imported from Japan's top-four brands such as Seiko, Star and Numona, " Chang points out. "Our machines run 24 hours a day and 365 day a year under a three-shift schedule to maximize productivity."

"Not every company that runs these top-end CNC lathes can achieve the same high and stable quality level as An-Lin, " Chang continues. He attributes his company's high performance to well-designed production lines and highly skilled workers, which the company sends to visit top-level CNC lathe-processing plants in Japan and Switzerland to learn how to improve production quality.

An-Lin plans to add 17 CNC lathes this year, including five top-end CNC machine centers, thereby elevating total capacity by at least 30%. The new machinery is expected to further upgrade An-Lin's high-volume production capability and help the company turn out new products, such as high-precision radio frequency (RF) connectors.

High-Tech Meters

Chao Long Motor Parts Corp. was established in 1974 and is now the largest original equipment (OE) meter/gauge supplier to major auto and motorcycle makers in Taiwan and many other nations.

Chao Long currently accounts for about 40% of the domestic automobile-meter market, with customers such as automakers Toyota, Ford, Suzuki, and Mitsubishi, and for about 80% of the domestic PTW-meter market.

Chao Long is also a leading supplier of meters to many big international PTW makers, including Yamaha's plants in Japan, Brazil, France, Spain, and Italy, as well as to Aprilia of Italy. The company supplies a majority of the most advanced meters used in new Yamaha PTW models produced worldwide. It also supplies meters for Yamaha's other overseas PTW plants. In addition, Chao Long ships meter parts to many important transportation-equipment meter makers around the world, including Siemens VDO as well as major companies in Italy and Pakistan.

Chao Long currently runs a plant in Guangdong Province, mainland China. The 100-plus-worker plant produces PTW meters and is scheduled to begin mass production of automobile meters in 2006. The company also plans to set up a new plant in Indonesia this year.

Last year, Chao Long shipped about 1.12 million PTW meter assemblies, about 2.3 million PTW meter movements, and about 200, 000 automobile-meter assemblies. This year, the company expects sales to improve by over 10%.

"Our competitive edge lies mainly in our unmatched R&D capability and high quality, " claims Chao Long managing director C. S. Lee. "Chao Long adopts an aggressive R&D strategy, whereby we integrate our experiences, techniques and know-how in both automobile and PTW meter lines and develop new products with unique and cutting-edge functions." Chao Long has over 20 R&D technicians with expertise in precision mechanisms, electronics and design.

In the past few years, Chao Long has integrated many advanced technologies and materials into its meter products. It is the first company in Taiwan to introduce meters with such functions as variable color modes and liquid crystal displays (LCDs). It is also the first local company to produce meter assemblies for both cars and PTWs.

Chao Long has also capitalized on its strong R&D capability to diversify into new product lines.

One of its innovative new products is a high-contrast meter with needles and markings that self-illuminate when the vehicle is in operation. The meter requires high-level optical design capability to guide the back lighting sources to the targeted spots, says Lee.

Chao Long is also Taiwan's only producer of stepping-motor meters, which read digital data from a group of sensors located in different parts of a vehicle and display the data in different ways such as point needles and numeric digits. Lee says that his company has developed a stepping motor meter for a local PTW maker, which is expected to become the world's second PTW maker to adopt such advanced meters next year.

High-Performance Tuning Parts

Established in 1997, Chian-yie Industrial Co., Ltd. Is a specialized maker of high-added-value performance-tuning parts for scooters and motorcycles. The company's NCY brand parts are widely known in Taiwan and have been gaining increasing popularity in overseas markets since Chian Yie began exporting about three years ago.

The firm designs and manufactures its major products, including aluminum-alloy scooter/motorcycle front fork assemblies (including shock absorbers), rear shock absorbers, CNC-processed aluminum-alloy multi-hole ventilation brake disks, multi-cylinder brake calipers, and engine-performance upgrading parts, such as extended cylinders and upgraded transmission gearboxes.

All of the company's products are aimed at the high-level tuning market, where quality and safety demands are high. Chian Yie has therefore invested heavily in top-end production and processing equipment to meet these rigorous standards.

In response to growing overseas demand, Chian Yie has been increasing investment in mold and die development to enrich the company's product range, says company president Chen Chung-jung. According to Chen, producers of mass-market PTWs place emphasis on enhancing riding comfort and minimizing production costs, rather than on maximizing overall performance. So, he adds, Chian Yie aims to develop better parts for upgrading road and racing PTWs through better steering mechanisms, higher horsepower output, and other performance enhancements.

Chian Yie, for example, has developed dozens of front and rear shock absorbers for mainstream scooter and motorcycle models in Taiwan and Japan and has been adding over 10 new items (for over 30 scooter or motorcycle models) each year. According to Chen, his company constantly hones the dampening and oil-circulation designs of original shock absorbers and makes the dampeners with the best aluminum-alloy and using CNC machine centers to achieve the highest precision level.

In addition, Chian Yie has developed a series of new brake-disk models made with special-formula materials that can greatly improve rust-resistance and braking. The company has also developed four-cylinder brake-caliper models for both scooters and motorcycles. The company is now developing advanced six-cylinder models that can give a significant speed boost to PTWs.

Chian Yie's NCY brand PTW tuning parts are rapidly gaining popularity in major export markets, including Japan, the U.S., and various Southeast Asia nations. The company claims that its core competitive edges lie mainly in the small-batch, large-variety production mode, high-precision processing ability, and strong and innovative development capability.

Better Than OE

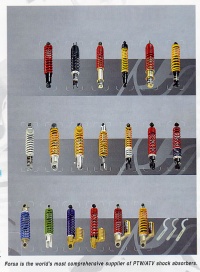

Forsa Enterprise Co., Ltd. Is also making headway in high-end markets. The company has developed over 400 shock-absorber models for PTW and ATV models in engine displacements ranging from 50cc to 1, 200cc, making it the world's most comprehensive supplier of such products. The company supplies products for both the aftermarket (AM) replacement and OE markets.

Forsa's market edge is based on more than 30 years of experience. The company was started as the shock absorber division of Fu Luong Hi-Tech Co., Ltd., a leading pneumatic actuator and gas spring maker in Taiwan, says company president Lu Ming-san.

Forsa supplies a comprehensive range of traditional PTW shock-absorber products, but in recent years it has been stepping up its presence in higher-margin and added-value markets. For example, Lu says, his company recently developed a top-end rear cushion model for use on Honda, Suzuki and Yamaha motorcycle models ranging from 400cc to 1, 200cc. The new rear cushion is made for the AM replacement market, Lu says, but it has features, such as a convenient spring-length adjustment mechanism, that even OE counterparts lack.

For the performance-tuning PTW-parts market, Forsa developed a series of gas/oil-separation shock absorber models, some with hand-finished surface treatment to add visual flair. Though costly and technically challenging to make, the new models make more efficient use of oil lubricant and their dampening index can be adjusted by the level of nitrogen gas in the unit.

Forsa supplied the shock absorbers to the first ATV model made in Taiwan and currently the company accounts for over 80% of the island's ATV shock-absorber market. According to Lu, Forsa has developed about 70 shock-absorber models for ATVs with engine displacements ranging from 400cc to 250cc and now the company is developing some new products for a 500cc ATV model, the largest one produced on the island. According to Lu, most ATV models adopt a single shock absorber in the rear-suspension system, posing a considerable challenge for shock-absorber makers.

Forsa is also tapping the automobile suspension-parts market. Lu says his company is ready to step into the automobile shock absorber production business and will first supply high-end models aimed at the performance-tuning market.

According to Lu, Forsa's products are widely adopted by major customers worldwide, including Kawasaki Philippines, Kitaco and Daytona of Japan, FNA of Brazil, and U.S. go-cart maker Carter.

Last year, Forsa sold about one million shock absorbers worldwide and Lu claims that few rivals can compete with Forsa's advantages in small-batch, large-variety production. "Forsa has the most flexible production system in the world, " Lu claims, "We accept orders for as few as 20 shock absorbers."

Forsa runs a highly automated plant in southern Taiwan's Tainan. The 65-worker plant is equipped with the most advanced production and testing equipment in the line. Lu says that his company can match leading Japanese brands, such as Showa and Kayaba, while offering much more competitive prices.

Forsa's revenues have been growing by over 10% annually over the past 10 years, even during economic downturns.

Lu says that Forsa does not have to move production to low-cost nations, at least for now, because the company's unmatched manufacturing capability and cost competitiveness have left it profitable enough. (March 2005)

Nevertheless, it has not all been easy sailing for local players. PTW-parts makers on the island today face a two-pronged threat--in the high-end market from rivals in industrially advanced countries and in the mass-market segment from competitors in low-cost countries, especially mainland China and nations in Southeast Asia.

Many local firms have responded to the intensifying competition by pouring more resources into R&D and manufacturing-process improvements in an effort to further pare costs while enhancing quality.

These efforts have helped make Taiwan a supplier of choice for the growing number of PTW brands in Japan and Europe that have been outsourcing parts production to cut costs.

Taiwan itself produces about 1.2 to 1.4 million PTWs each year. Increasingly, however, producers are seeking to expand overseas sales to offset the stagnant growth being experienced in the heavily saturated domestic market. In the past five years many local PTW makers have set up overseas plants to tap major markets, and local PTW-parts makers have followed suit to supply not only their expatriated compatriots but also new local customers in such quickly expanding markets as Indonesia, India, mainland China, and Vietnam.

Still, many PTW-parts manufacturers have chosen to maintain part or all of their production capacity in Taiwan, honing their competitive edge with highly automated and flexible production lines and innovative cost-cutting measures, such as using a high ratio of standardized components in their products.

High-Precision Parts

One example is An-Lin Technology Industrial Co., Ltd., which supplies high-precision CMC lathe-processed parts and components to all major PTW and ATV makers as well many leading auto-parts makers in Taiwan. An-Lin is an ISO 9001 certified company and is scheduled to win the ISO/TS-16949 quality certification this year.

An-Lin sales manager Chang Chin-chiung says his company now supplies a wide range of precision parts to the transportation-equipment line, including automobile water-pump shafts and thermostat pins (auto parts currently account for 20% of the company's sales); and piston pins, oil-pump shafts, carburetor parts (throttle valves, nozzles, jet needles, etc.), collars and bushings for PTW and ATV frames and engines (80%). The company plays a key role in the local PTW/ATV line as it supplies products to most leading makers and tier-one parts suppliers.

According to Chang, An-Lin has been focusing on auto and PTW parts since its establishment 20 years ago and it has garnered a lot of experience in that time. The company develops dies and produces own CNC lathes. Heat-treatment and grinding work are contracted out to satellite plants with long ties to the company.

An-Lin's core competitiveness, Chang stresses, lies in the company's price, quality, and on-time delivery, which, he claims, is unmatched among the company's local industry peers. "An-Lin now owns 50 CNC lathes, all of which are imported from Japan's top-four brands such as Seiko, Star and Numona, " Chang points out. "Our machines run 24 hours a day and 365 day a year under a three-shift schedule to maximize productivity."

"Not every company that runs these top-end CNC lathes can achieve the same high and stable quality level as An-Lin, " Chang continues. He attributes his company's high performance to well-designed production lines and highly skilled workers, which the company sends to visit top-level CNC lathe-processing plants in Japan and Switzerland to learn how to improve production quality.

An-Lin plans to add 17 CNC lathes this year, including five top-end CNC machine centers, thereby elevating total capacity by at least 30%. The new machinery is expected to further upgrade An-Lin's high-volume production capability and help the company turn out new products, such as high-precision radio frequency (RF) connectors.

High-Tech Meters

Chao Long Motor Parts Corp. was established in 1974 and is now the largest original equipment (OE) meter/gauge supplier to major auto and motorcycle makers in Taiwan and many other nations.

Chao Long currently accounts for about 40% of the domestic automobile-meter market, with customers such as automakers Toyota, Ford, Suzuki, and Mitsubishi, and for about 80% of the domestic PTW-meter market.

Chao Long is also a leading supplier of meters to many big international PTW makers, including Yamaha's plants in Japan, Brazil, France, Spain, and Italy, as well as to Aprilia of Italy. The company supplies a majority of the most advanced meters used in new Yamaha PTW models produced worldwide. It also supplies meters for Yamaha's other overseas PTW plants. In addition, Chao Long ships meter parts to many important transportation-equipment meter makers around the world, including Siemens VDO as well as major companies in Italy and Pakistan.

Chao Long currently runs a plant in Guangdong Province, mainland China. The 100-plus-worker plant produces PTW meters and is scheduled to begin mass production of automobile meters in 2006. The company also plans to set up a new plant in Indonesia this year.

Last year, Chao Long shipped about 1.12 million PTW meter assemblies, about 2.3 million PTW meter movements, and about 200, 000 automobile-meter assemblies. This year, the company expects sales to improve by over 10%.

"Our competitive edge lies mainly in our unmatched R&D capability and high quality, " claims Chao Long managing director C. S. Lee. "Chao Long adopts an aggressive R&D strategy, whereby we integrate our experiences, techniques and know-how in both automobile and PTW meter lines and develop new products with unique and cutting-edge functions." Chao Long has over 20 R&D technicians with expertise in precision mechanisms, electronics and design.

In the past few years, Chao Long has integrated many advanced technologies and materials into its meter products. It is the first company in Taiwan to introduce meters with such functions as variable color modes and liquid crystal displays (LCDs). It is also the first local company to produce meter assemblies for both cars and PTWs.

Chao Long has also capitalized on its strong R&D capability to diversify into new product lines.

One of its innovative new products is a high-contrast meter with needles and markings that self-illuminate when the vehicle is in operation. The meter requires high-level optical design capability to guide the back lighting sources to the targeted spots, says Lee.

Chao Long is also Taiwan's only producer of stepping-motor meters, which read digital data from a group of sensors located in different parts of a vehicle and display the data in different ways such as point needles and numeric digits. Lee says that his company has developed a stepping motor meter for a local PTW maker, which is expected to become the world's second PTW maker to adopt such advanced meters next year.

High-Performance Tuning Parts

Established in 1997, Chian-yie Industrial Co., Ltd. Is a specialized maker of high-added-value performance-tuning parts for scooters and motorcycles. The company's NCY brand parts are widely known in Taiwan and have been gaining increasing popularity in overseas markets since Chian Yie began exporting about three years ago.

The firm designs and manufactures its major products, including aluminum-alloy scooter/motorcycle front fork assemblies (including shock absorbers), rear shock absorbers, CNC-processed aluminum-alloy multi-hole ventilation brake disks, multi-cylinder brake calipers, and engine-performance upgrading parts, such as extended cylinders and upgraded transmission gearboxes.

All of the company's products are aimed at the high-level tuning market, where quality and safety demands are high. Chian Yie has therefore invested heavily in top-end production and processing equipment to meet these rigorous standards.

In response to growing overseas demand, Chian Yie has been increasing investment in mold and die development to enrich the company's product range, says company president Chen Chung-jung. According to Chen, producers of mass-market PTWs place emphasis on enhancing riding comfort and minimizing production costs, rather than on maximizing overall performance. So, he adds, Chian Yie aims to develop better parts for upgrading road and racing PTWs through better steering mechanisms, higher horsepower output, and other performance enhancements.

Chian Yie, for example, has developed dozens of front and rear shock absorbers for mainstream scooter and motorcycle models in Taiwan and Japan and has been adding over 10 new items (for over 30 scooter or motorcycle models) each year. According to Chen, his company constantly hones the dampening and oil-circulation designs of original shock absorbers and makes the dampeners with the best aluminum-alloy and using CNC machine centers to achieve the highest precision level.

In addition, Chian Yie has developed a series of new brake-disk models made with special-formula materials that can greatly improve rust-resistance and braking. The company has also developed four-cylinder brake-caliper models for both scooters and motorcycles. The company is now developing advanced six-cylinder models that can give a significant speed boost to PTWs.

Chian Yie's NCY brand PTW tuning parts are rapidly gaining popularity in major export markets, including Japan, the U.S., and various Southeast Asia nations. The company claims that its core competitive edges lie mainly in the small-batch, large-variety production mode, high-precision processing ability, and strong and innovative development capability.

Better Than OE

Forsa Enterprise Co., Ltd. Is also making headway in high-end markets. The company has developed over 400 shock-absorber models for PTW and ATV models in engine displacements ranging from 50cc to 1, 200cc, making it the world's most comprehensive supplier of such products. The company supplies products for both the aftermarket (AM) replacement and OE markets.

Forsa's market edge is based on more than 30 years of experience. The company was started as the shock absorber division of Fu Luong Hi-Tech Co., Ltd., a leading pneumatic actuator and gas spring maker in Taiwan, says company president Lu Ming-san.

Forsa supplies a comprehensive range of traditional PTW shock-absorber products, but in recent years it has been stepping up its presence in higher-margin and added-value markets. For example, Lu says, his company recently developed a top-end rear cushion model for use on Honda, Suzuki and Yamaha motorcycle models ranging from 400cc to 1, 200cc. The new rear cushion is made for the AM replacement market, Lu says, but it has features, such as a convenient spring-length adjustment mechanism, that even OE counterparts lack.

For the performance-tuning PTW-parts market, Forsa developed a series of gas/oil-separation shock absorber models, some with hand-finished surface treatment to add visual flair. Though costly and technically challenging to make, the new models make more efficient use of oil lubricant and their dampening index can be adjusted by the level of nitrogen gas in the unit.

Forsa supplied the shock absorbers to the first ATV model made in Taiwan and currently the company accounts for over 80% of the island's ATV shock-absorber market. According to Lu, Forsa has developed about 70 shock-absorber models for ATVs with engine displacements ranging from 400cc to 250cc and now the company is developing some new products for a 500cc ATV model, the largest one produced on the island. According to Lu, most ATV models adopt a single shock absorber in the rear-suspension system, posing a considerable challenge for shock-absorber makers.

Forsa is also tapping the automobile suspension-parts market. Lu says his company is ready to step into the automobile shock absorber production business and will first supply high-end models aimed at the performance-tuning market.

According to Lu, Forsa's products are widely adopted by major customers worldwide, including Kawasaki Philippines, Kitaco and Daytona of Japan, FNA of Brazil, and U.S. go-cart maker Carter.

Last year, Forsa sold about one million shock absorbers worldwide and Lu claims that few rivals can compete with Forsa's advantages in small-batch, large-variety production. "Forsa has the most flexible production system in the world, " Lu claims, "We accept orders for as few as 20 shock absorbers."

Forsa runs a highly automated plant in southern Taiwan's Tainan. The 65-worker plant is equipped with the most advanced production and testing equipment in the line. Lu says that his company can match leading Japanese brands, such as Showa and Kayaba, while offering much more competitive prices.

Forsa's revenues have been growing by over 10% annually over the past 10 years, even during economic downturns.

Lu says that Forsa does not have to move production to low-cost nations, at least for now, because the company's unmatched manufacturing capability and cost competitiveness have left it profitable enough. (March 2005)

©1995-2006 Copyright China Economic News Service All Rights Reserved.