Taiwan PTW Parts Makers Go Global

Jun 25, 2004 Ι Industry News Ι Powersports Ι By Quincy, CENS

Taiwan is quickly building a name as one of the world's top suppliers of parts for powered two-wheeler (PTWs) and all-terrain vehicles (ATVs), thanks to the high quality and reasonable pricing of parts made on the island.

But it has not all been easy sailing. PTW-parts makers in Taiwan today face a two-pronged threat--in the high-end market from rivals in industrially advanced countries and in the mass-market segment from competitors in low-cost countries, especially mainland China and from Southeast Asia.

Many local firms have responded to the intensifying competition by pouring more resources into R&D and manufacturing improvements aimed at further paring costs while enhancing quality.

These efforts have helped make Taiwan the supplier of choice for the growing numbers of PTW brands in Japan and Europe that have been outsourcing parts to cut costs.

Taiwan produces about 1.2 to 1.4 million PTWs each year. Increasingly, however, producers are depending on overseas markets to offset stagnant growth in the heavily saturated domestic market. In the past five years, many local PTW makers have set up overseas plants to tap major markets, and local PTW-parts makers have followed suit to supply not only their expatriated compatriots but also new local customers in such quickly expanding markets as Indonesia, India, mainland China, and Vietnam.

Still, many PTW-parts manufacturers are sticking it out in Taiwan, honing their competitive edge with highly automated and flexible production lines and innovative cost-cutting measures, such as using a high ratio of standardized components in their products.

Diversification into new fields has opened another door to growth for Taiwan-based PTW-parts makers. This means not only developing higher-end products for the PTW market, but also migrating their production capability to non-PTW lines.

Hi-Tech Meters

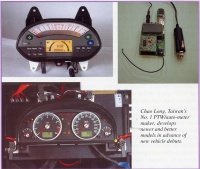

One example is Chao Long Motor Parts Corp., which was established in 1974 and is now the largest original equipment (OE) meter/gauge supplier to major auto and motorcycle makers in Taiwan and many other nations.

Chao Long currently accounts for about 40% of the domestic automobile-meter market, with customers such as automakers Toyota, Ford, Suzuki, and Mitsubishi, and for about 80% of the island's motorcycle/scooter-meter market.

Chao Long is also a leading supplier of PTW meters to many big international PTW makers, including Yamaha's plants in Japan, Brazil, France, Spain, and Italy, as well as Aprilia of Italy. The company supplies a majority of the most advanced meter products used by Yamaha in new PTW models produced worldwide. It also designs and develops meter models for Yamaha's other overseas PTW plants. In addition, Chao Long ships meter movements to many important transportation-equipment meter makers in the world, including Siemens VDO as well as major companies in Italy and Pakistan.

Chao Long currently runs a plant in Guangdong Province, mainland China. The 100-plus-worker plant produces PTW meters and is scheduled to begin mass production of automobile meters in 2006. The company also plans to set up a new plant in Indonesia this year.

Last year, Chao Long shipped about 1.12 million PTW meter assemblies, about 2.3 million PTW meter movements, and about 200,000 automobile meter assemblies. This year, the company expects sales to improve by over 10%.

"Our competitive edge lies mainly in our unmatched R&D capability and high quality," claims Chao Long managing director C. S. Lee. "Chao Long adopts an aggressive R&D strategy, whereby we integrate our experiences, techniques and know-how in both automobile and PTW meter lines and develop new products with unique and cutting-edge functions." Chao Long has over 20 R&D technicians with expertise in various fields, including precision mechanisms, electronics and design.

In the past few years, Chao Long has integrated many advanced technologies and materials into its meter products. It is the first company in Taiwan to introduce meters with such functions as variable color modes and liquid crystal displays (LCDs). It is also the first local company to produce meter assemblies for both cars and PTWs.

Chao Long has also capitalized on its strong R&D capability to diversify into new product lines.

One of its innovative new products is a high-contrast meter with needles and markings that self-illuminate when the vehicle is in operation. The meter requires high-level optical design capability to guide the back lighting sources to the targeted spots, says Lee.

Chao Long is also Taiwan's only producer of stepping-motor meters, which read digital data from a group of sensors located in different parts of a vehicle and display the data in different ways such as point needles and numeric digits. Lee says that his company has developed a stepping motor meter for a local PTW maker, which is expected to become the world's second PTW maker to adopt such advanced meters next year.

Chao Long also recently developed a mini portable and wireless MP3 broadcasting device that is expected to make waves in the car-audio market in the near future. According Lee, the MP3 player is smaller than a cigarette box and can be connected to the in-car cigarette lighter socket. The device plays MP3 music data stored in a flash memory pen connected to the device's USB port and transmits the digital signals to a car's stereo system.

Chao Long is also planning to incorporate some new applications into the mini MP3 device, including Bluetooth connectivity and wireless transmission to built-in thin-film speakers in PTW riders' helmets.

Another Chao Long innovation is an anti-collision alarm system for both cars and PTWs. With a built-in infrared sensor, the system automatically flashes an attached light-emitting diode (LED) light to warn riders of vehicles approaching from behind.

Kick-Starter King

Like Chao Long, Shuenn Yueh Industry Co, Ltd. Has been making a name in the high end of various markets with its high-quality products. The company specializes in forging and processing for numerous kinds of motorcycle/automobile parts and accessories and is a major supplier to most major PTW and ATV makers in Taiwan as well as many big international PTW brands in Southeast Asia.

Shuenn Yueh supplies a wide range of products, including PTW steering stems and engine hangers, PTW and ATV kick-starters, speed-change levers, ATV steering systems and parts, ATV rear-drive system parts, PTW locks, piston-connection rods, transmission forks, and many other items.

The company is a major OE supplier to leading PTW makers in Taiwan, such as Kwang Yang Motor Co., Ltd. (KYMCO brand), Yamaha Taiwan, and all of the local ATV makers. Currently, the company runs a plant in Taiwan with about 110 workers and another facility in Indonesia (set up in 1991) with over 300 workers. In Indonesia, Shuenn Yueh supplies many products to Yamaha, Honda, Suzuki, and Kwang Yang's PTW plants.

Shuenn Yueh claims that it is the largest PTW/ATV kick-starter supplier in Asia with an annual production volume of about two million units. In addition, the company supplies front steering systems and parts to all ATV makers in Taiwan. Last year, Shuenn Yueh also shipped about 500,000 steering-stem assemblies, about 300,000 ATV front steering systems, and about 150,000 PTW locks.

Established in 1973, Shuenn Yueh has grown over the last three years to become a leading OE supplier to major PTW makers around the world by constantly elevating its design and production capability.

According to company general manager Liu Ting-yu, Shuenn Yueh has made considerable progress in trimming the weight of its PTW and auto parts by aluminum-forging methods. The ability to make low-weight products, he says, is critical to success in this line.

Shuenn Yueh's other competitive edge is its superb management. The ISO9002- and QS9000-approved maker places top priority on quality, which means asking each and every employee to follow a strict quality-control system in their daily work. According to Liu, Shuenn Yueh conducts first/last product tests every day and compiles daily, weekly and monthly quality analyses. In addition, the company uses high precision production and testing equipment to assure the top quality results.

After gaining a solid foothold in the PTW-parts industry, Shuenn Yueh plans to expand into the auto-parts market. Liu says that his company is expected to win more OE orders from customers in Taiwan and overseas nations since its QDC (quality, delivery and cost control) capability meets the strict requirements of many auto/PTW makers.

Better Than OE

Forsa Enterprise Co., Ltd. Is also making headway in high-end markets. The company has developed over 400 shock-absorber models for PTW and ATV models in engine displacements ranging from 50cc to 1,200cc, making it the world's most comprehensive supplier of such products, according to a company spokesperson. The company supplies products for both the aftermarket (AM) replacement and OE markets.

Forsa's market edge is based on more than 30 years of experience, beginning from its former years as the shock absorber division of Fu Luong Hi-Tech Co., Ltd., a leading pneumatic actuator and gas spring maker in Taiwan, says company president Lu Ming-san.

Forsa supplies a comprehensive range of traditional PTW shock absorber products, but in recent years it has been stepping up its presence in higher-margin and value-added markets. For example, Lu says, his company recently developed a top-end rear cushion model for use on Honda, Suzuki and Yamaha motorcycle models ranging from 400cc to 1,200cc. The new rear cushion is made for the AM replacement market, Lu says, but it has features, such as a convenient spring-length adjustment mechanism, not found on OE counterparts.

For the performance-tuning PTW parts market, Forsa developed a series of gas/oil-separation shock absorber models, some with hand-finished surface treatment to improve the visual effect. Though costly and technically challenging to make, the gas/oil separation shock absorber models make more efficient use of oil lubricant and their dampening index can be adjusted by injecting or releasing nitrogen gas in the unit.

Forsa supplied the shock absorbers to the first ATV model made in Taiwan and currently the company accounts for over 80% of the island's ATV shock absorber market. According to Lu, Forsa has developed about 60 shock absorber models for ATVs with engine displacements ranging from 20cc to 250cc and now the company is developing some new products for a 500cc ATV model, the largest one produced on the island. According to Lu, most ATV models adopt single shock absorber in the rear suspension system, posing a considerable challenge for shock absorber makers.

Forsa is also tapping the automobile suspension parts market. According to Lu, his company is ready to step into the automobile shock absorber production business and will first supply high-end models aimed at the performance-tuning market.

According to Lu, Forsa's products are widely adopted by major customers worldwide, including Kawasaki Philippines, Kitaco and Daytona of Japan (leading AM PTW parts distributors), FNA (the No. 1 PTW shock absorber maker in Brazil), and Carter of the U.S. (go-cart maker).

Last year, Forsa sold about one million shock absorbers worldwide and Lu claims that any rival can hardly compete with Forsa's advantages in small-batch, large-variety production. "Forsa has the most flexible production in the world," Lu claims, "We accept orders for as few as 20 shock absorbers."

Forsa currently runs a highly automated plant in southern Taiwan's Tainan. The 65-worker plant is equipped with the most advanced production and testing equipment in the line. "We are very proud that our product quality has paralleled that of leading Japanese brands such as Showa and Kayaba but at prices that are much more competitive."

Forsa has enjoyed over-10% sales growths for over 10 years, even during economic downturns.

Lu says that Forsa does not have to move production to low-cost nations, at least for now, because the company's unmatched manufacturing capability and cost competitiveness have left it profitable enough.

Contact information on companies covered by the article:

Chao Long Motor Parts Corp.

No. 10, Lane 151, Kwangmin Rd., Sec. 2, Luchu Village, Taoyuan Hsien 338, Taiwan

Tel: (886-3) 3223711~8

Fax: (886-3) 3224046

Website: www.chaolong.com.tw

E-mail: chlong@chaolong.com.tw

Shuenn Yueh Industry Co., Ltd.

No.,6, Lane 23, Chungcheng Rd., Hsinshih Hsiang, Tainan Hsien, Taiwan

Tel: (886-6) 5992856

Fax : (886-6) 5996649, 5993189

Website: www.shuennyueh.com.tw

E-mail: Syid@ms9.hinet.net

Forsa Enterprise Co., Ltd.

No. 6, Jingchung Rd., Yungkang Industrial Park, Tainan 710, Taiwan

Tel: (886-6) 2317577~79

Fax: (886-2) 2030948

Website: www.forsa.mdi.com; www.absorber.com.tw

E-mail: forsa@ms48.hinet.net

But it has not all been easy sailing. PTW-parts makers in Taiwan today face a two-pronged threat--in the high-end market from rivals in industrially advanced countries and in the mass-market segment from competitors in low-cost countries, especially mainland China and from Southeast Asia.

Many local firms have responded to the intensifying competition by pouring more resources into R&D and manufacturing improvements aimed at further paring costs while enhancing quality.

These efforts have helped make Taiwan the supplier of choice for the growing numbers of PTW brands in Japan and Europe that have been outsourcing parts to cut costs.

Taiwan produces about 1.2 to 1.4 million PTWs each year. Increasingly, however, producers are depending on overseas markets to offset stagnant growth in the heavily saturated domestic market. In the past five years, many local PTW makers have set up overseas plants to tap major markets, and local PTW-parts makers have followed suit to supply not only their expatriated compatriots but also new local customers in such quickly expanding markets as Indonesia, India, mainland China, and Vietnam.

Still, many PTW-parts manufacturers are sticking it out in Taiwan, honing their competitive edge with highly automated and flexible production lines and innovative cost-cutting measures, such as using a high ratio of standardized components in their products.

Diversification into new fields has opened another door to growth for Taiwan-based PTW-parts makers. This means not only developing higher-end products for the PTW market, but also migrating their production capability to non-PTW lines.

Hi-Tech Meters

One example is Chao Long Motor Parts Corp., which was established in 1974 and is now the largest original equipment (OE) meter/gauge supplier to major auto and motorcycle makers in Taiwan and many other nations.

Chao Long currently accounts for about 40% of the domestic automobile-meter market, with customers such as automakers Toyota, Ford, Suzuki, and Mitsubishi, and for about 80% of the island's motorcycle/scooter-meter market.

Chao Long is also a leading supplier of PTW meters to many big international PTW makers, including Yamaha's plants in Japan, Brazil, France, Spain, and Italy, as well as Aprilia of Italy. The company supplies a majority of the most advanced meter products used by Yamaha in new PTW models produced worldwide. It also designs and develops meter models for Yamaha's other overseas PTW plants. In addition, Chao Long ships meter movements to many important transportation-equipment meter makers in the world, including Siemens VDO as well as major companies in Italy and Pakistan.

Chao Long currently runs a plant in Guangdong Province, mainland China. The 100-plus-worker plant produces PTW meters and is scheduled to begin mass production of automobile meters in 2006. The company also plans to set up a new plant in Indonesia this year.

Last year, Chao Long shipped about 1.12 million PTW meter assemblies, about 2.3 million PTW meter movements, and about 200,000 automobile meter assemblies. This year, the company expects sales to improve by over 10%.

"Our competitive edge lies mainly in our unmatched R&D capability and high quality," claims Chao Long managing director C. S. Lee. "Chao Long adopts an aggressive R&D strategy, whereby we integrate our experiences, techniques and know-how in both automobile and PTW meter lines and develop new products with unique and cutting-edge functions." Chao Long has over 20 R&D technicians with expertise in various fields, including precision mechanisms, electronics and design.

In the past few years, Chao Long has integrated many advanced technologies and materials into its meter products. It is the first company in Taiwan to introduce meters with such functions as variable color modes and liquid crystal displays (LCDs). It is also the first local company to produce meter assemblies for both cars and PTWs.

Chao Long has also capitalized on its strong R&D capability to diversify into new product lines.

One of its innovative new products is a high-contrast meter with needles and markings that self-illuminate when the vehicle is in operation. The meter requires high-level optical design capability to guide the back lighting sources to the targeted spots, says Lee.

Chao Long is also Taiwan's only producer of stepping-motor meters, which read digital data from a group of sensors located in different parts of a vehicle and display the data in different ways such as point needles and numeric digits. Lee says that his company has developed a stepping motor meter for a local PTW maker, which is expected to become the world's second PTW maker to adopt such advanced meters next year.

Chao Long also recently developed a mini portable and wireless MP3 broadcasting device that is expected to make waves in the car-audio market in the near future. According Lee, the MP3 player is smaller than a cigarette box and can be connected to the in-car cigarette lighter socket. The device plays MP3 music data stored in a flash memory pen connected to the device's USB port and transmits the digital signals to a car's stereo system.

Chao Long is also planning to incorporate some new applications into the mini MP3 device, including Bluetooth connectivity and wireless transmission to built-in thin-film speakers in PTW riders' helmets.

Another Chao Long innovation is an anti-collision alarm system for both cars and PTWs. With a built-in infrared sensor, the system automatically flashes an attached light-emitting diode (LED) light to warn riders of vehicles approaching from behind.

Kick-Starter King

Like Chao Long, Shuenn Yueh Industry Co, Ltd. Has been making a name in the high end of various markets with its high-quality products. The company specializes in forging and processing for numerous kinds of motorcycle/automobile parts and accessories and is a major supplier to most major PTW and ATV makers in Taiwan as well as many big international PTW brands in Southeast Asia.

Shuenn Yueh supplies a wide range of products, including PTW steering stems and engine hangers, PTW and ATV kick-starters, speed-change levers, ATV steering systems and parts, ATV rear-drive system parts, PTW locks, piston-connection rods, transmission forks, and many other items.

The company is a major OE supplier to leading PTW makers in Taiwan, such as Kwang Yang Motor Co., Ltd. (KYMCO brand), Yamaha Taiwan, and all of the local ATV makers. Currently, the company runs a plant in Taiwan with about 110 workers and another facility in Indonesia (set up in 1991) with over 300 workers. In Indonesia, Shuenn Yueh supplies many products to Yamaha, Honda, Suzuki, and Kwang Yang's PTW plants.

Shuenn Yueh claims that it is the largest PTW/ATV kick-starter supplier in Asia with an annual production volume of about two million units. In addition, the company supplies front steering systems and parts to all ATV makers in Taiwan. Last year, Shuenn Yueh also shipped about 500,000 steering-stem assemblies, about 300,000 ATV front steering systems, and about 150,000 PTW locks.

Established in 1973, Shuenn Yueh has grown over the last three years to become a leading OE supplier to major PTW makers around the world by constantly elevating its design and production capability.

According to company general manager Liu Ting-yu, Shuenn Yueh has made considerable progress in trimming the weight of its PTW and auto parts by aluminum-forging methods. The ability to make low-weight products, he says, is critical to success in this line.

Shuenn Yueh's other competitive edge is its superb management. The ISO9002- and QS9000-approved maker places top priority on quality, which means asking each and every employee to follow a strict quality-control system in their daily work. According to Liu, Shuenn Yueh conducts first/last product tests every day and compiles daily, weekly and monthly quality analyses. In addition, the company uses high precision production and testing equipment to assure the top quality results.

After gaining a solid foothold in the PTW-parts industry, Shuenn Yueh plans to expand into the auto-parts market. Liu says that his company is expected to win more OE orders from customers in Taiwan and overseas nations since its QDC (quality, delivery and cost control) capability meets the strict requirements of many auto/PTW makers.

Better Than OE

Forsa Enterprise Co., Ltd. Is also making headway in high-end markets. The company has developed over 400 shock-absorber models for PTW and ATV models in engine displacements ranging from 50cc to 1,200cc, making it the world's most comprehensive supplier of such products, according to a company spokesperson. The company supplies products for both the aftermarket (AM) replacement and OE markets.

Forsa's market edge is based on more than 30 years of experience, beginning from its former years as the shock absorber division of Fu Luong Hi-Tech Co., Ltd., a leading pneumatic actuator and gas spring maker in Taiwan, says company president Lu Ming-san.

Forsa supplies a comprehensive range of traditional PTW shock absorber products, but in recent years it has been stepping up its presence in higher-margin and value-added markets. For example, Lu says, his company recently developed a top-end rear cushion model for use on Honda, Suzuki and Yamaha motorcycle models ranging from 400cc to 1,200cc. The new rear cushion is made for the AM replacement market, Lu says, but it has features, such as a convenient spring-length adjustment mechanism, not found on OE counterparts.

For the performance-tuning PTW parts market, Forsa developed a series of gas/oil-separation shock absorber models, some with hand-finished surface treatment to improve the visual effect. Though costly and technically challenging to make, the gas/oil separation shock absorber models make more efficient use of oil lubricant and their dampening index can be adjusted by injecting or releasing nitrogen gas in the unit.

Forsa supplied the shock absorbers to the first ATV model made in Taiwan and currently the company accounts for over 80% of the island's ATV shock absorber market. According to Lu, Forsa has developed about 60 shock absorber models for ATVs with engine displacements ranging from 20cc to 250cc and now the company is developing some new products for a 500cc ATV model, the largest one produced on the island. According to Lu, most ATV models adopt single shock absorber in the rear suspension system, posing a considerable challenge for shock absorber makers.

Forsa is also tapping the automobile suspension parts market. According to Lu, his company is ready to step into the automobile shock absorber production business and will first supply high-end models aimed at the performance-tuning market.

According to Lu, Forsa's products are widely adopted by major customers worldwide, including Kawasaki Philippines, Kitaco and Daytona of Japan (leading AM PTW parts distributors), FNA (the No. 1 PTW shock absorber maker in Brazil), and Carter of the U.S. (go-cart maker).

Last year, Forsa sold about one million shock absorbers worldwide and Lu claims that any rival can hardly compete with Forsa's advantages in small-batch, large-variety production. "Forsa has the most flexible production in the world," Lu claims, "We accept orders for as few as 20 shock absorbers."

Forsa currently runs a highly automated plant in southern Taiwan's Tainan. The 65-worker plant is equipped with the most advanced production and testing equipment in the line. "We are very proud that our product quality has paralleled that of leading Japanese brands such as Showa and Kayaba but at prices that are much more competitive."

Forsa has enjoyed over-10% sales growths for over 10 years, even during economic downturns.

Lu says that Forsa does not have to move production to low-cost nations, at least for now, because the company's unmatched manufacturing capability and cost competitiveness have left it profitable enough.

Contact information on companies covered by the article:

Chao Long Motor Parts Corp.

No. 10, Lane 151, Kwangmin Rd., Sec. 2, Luchu Village, Taoyuan Hsien 338, Taiwan

Tel: (886-3) 3223711~8

Fax: (886-3) 3224046

Website: www.chaolong.com.tw

E-mail: chlong@chaolong.com.tw

Shuenn Yueh Industry Co., Ltd.

No.,6, Lane 23, Chungcheng Rd., Hsinshih Hsiang, Tainan Hsien, Taiwan

Tel: (886-6) 5992856

Fax : (886-6) 5996649, 5993189

Website: www.shuennyueh.com.tw

E-mail: Syid@ms9.hinet.net

Forsa Enterprise Co., Ltd.

No. 6, Jingchung Rd., Yungkang Industrial Park, Tainan 710, Taiwan

Tel: (886-6) 2317577~79

Fax: (886-2) 2030948

Website: www.forsa.mdi.com; www.absorber.com.tw

E-mail: forsa@ms48.hinet.net

©1995-2006 Copyright China Economic News Service All Rights Reserved.