Change on the menu for automotive trends, yet disrupted supply chains pose challenges

2022/03/29 | By CENS

After two years of the COVID-19 pandemic and the world grappling with Russia’s invasion of Ukraine that began on February 24, supply chain disruptions that have derailed many industries are forecasted to continue well into 2022, amid a myriad of trends and problems. In this section, we discuss industry trends in three main areas.

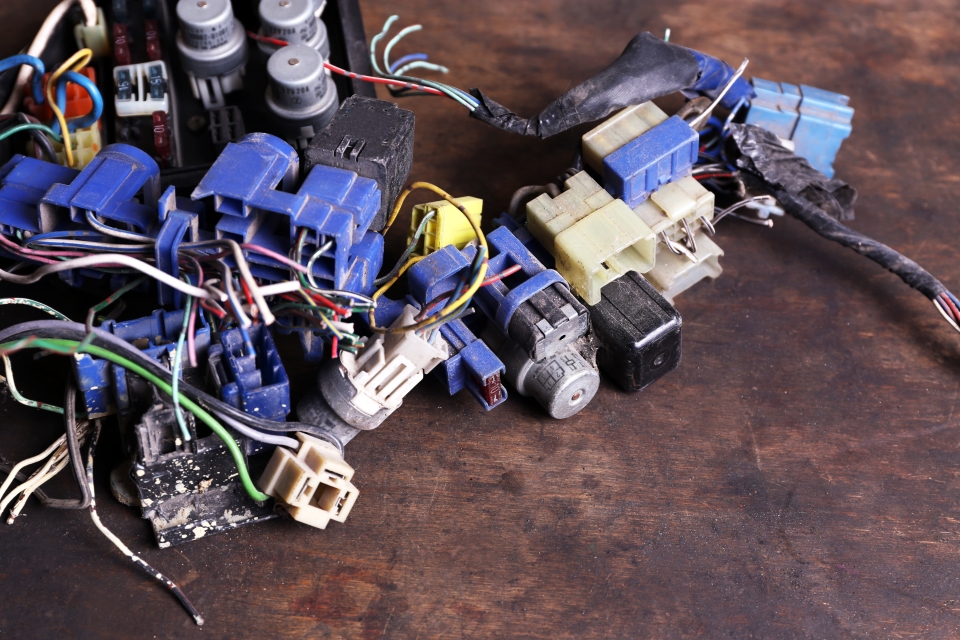

Auto Parts

Auto parts, or more specifically, aftermarket (AM) parts, have seen a strong surge in demand. Industry Research reports that the global automotive parts and components market size is expected to reach USD$2258.72 billion by 2027. According to LinchpinSEO, the U.S. auto AM, Taiwan’s biggest export destination market, captured USD$16 billion in market share through eCommerce in 2020, marking nearly a USD$2 billion increase over initial forecasts for the year.

The pandemic had spurred consumers to take to online shopping as in-person shops posed health risks due to social gatherings. Tighter reins on money also propelled consumers to delay purchasing new vehicles, and opt for extending the lifespan of their existing owned cars instead.

As electric vehicle (EV) ownership is becoming more and more popular in markets around the world, auto parts and AM auto part suppliers are also looking to increase their market presence in these areas as well. Expect more and more AM alternatives to the normally-pricey EV or in markets like Taiwan, electric scooters, as the consumer base using these transportation methods increases.

Auto parts suppliers are cognizant regarding the status of the world’s automotive and overall industry situation. There is not another moment in recent decades where the consistent supply of auto parts is more crucial than ever. For example, due to congested supply chains and shipping ports, auto parts and components have been in more demand in markets around the world, as consumers are holding onto their older vehicles longer than purchasing new vehicles. In parts of the world that are heavily reliant on long-distance trucking shipping, shipping companies are unable to maintain pre-disrupted fleet levels as they are unable to service trucks without the necessary components. New trucks are not arriving either, worsening the situation.

Automotive Electronics and EV

Unfortunately, the Russia-Ukraine conflict has upended what should have been a global economic recovery, worsening the overall situation amid rising prices in raw materials, unstable shipping prices and markets, and a recovering supply chain. Amid these raw materials include nickel, in which early March, the nickel market saw so much instability that the LME suspended trading due to price surges. This has led Chinese new-energy vehicle makers to look to hike prices as well.

Unstable and inflating raw material and metal prices pose a crucial concern for the growing EV market, in a time when overall technology advancements have helped push down the barrier of entry to become an EV owner. The World Economic Forum estimates that by 2040, the world’s EV sales will reach 500 million units, a fleet that will require at least 290 million charging stations to maintain and power.

Take the EV market in Taiwan for example, statistics show that the number of newly registered EVs on January 10, 2021, amounted to 5,221 units. Even with the COVID-19 pandemic surging, causing a shortage of automotive semiconductors that is gradually lessening, EV sales still reached a year-on-year increase of 74%. As of the release of these statistics, Taiwan’s yearly EV registration numbers have already exceeded 16,000 units.

Disruption Will Continue

Despite the general sentiment to return to pre-COVID social norms and economic conditions, experts have routinely warned that the current situations and conditions could be here to stay in the following years. According to IHS Markit’s “The Great Supply Chain Disruption: Why it continues in 2022” report, a number of global circumstances, not just the impacts from the pandemic and the Russian-Ukraine conflict, have contributed to the worsening supply chain. Delays and disruptions for manufacturers and deliveries on a scale unprecedented in the past 30 years of globalization, container shipping networks remain jammed, existing and incoming constraints on various types of computer chips, strained capacity in world oil output, endemic shortages of labor and materials, as well as the significance of geopolitics and ESG on supply chains and company strategies.

Writing for the section on automotive in the report, Matteo Fini, Vice President, Automotive Supply Chain and Technology, says that 2022 is highly another write-off, as the limitations on the current manufacturing inputs are unlikely to be resolved in the short term. While the chip shortages are largely under control now, Fini warned that the shocks caused by these shortages in the first place will persist for a time. Automakers will need to make tradeoffs when producing vehicles in 2022.

Fini writes that another area of concern in the automotive supply chain is electrical steel, which for EVs, is a grade of steel used in significant amounts specifically in electric motors for propulsion. Very similar to how semiconductor production is concentrated in Asian countries, two-thirds of the production for electrical steel takes place in China and South Korea as well. As of writing, China and South Korea are facing their own Omicron-fueled outbreaks that are at their worst since the pandemic broke out two years ago.

As there are only 20 manufacturing sites in the world that can produce automotive-grade electrical steel, with none based in North America, plans to roll out new-energy alternatives in a world that are increasingly looking towards net-zero carbon initiatives to combat climate change, will largely be impacted in a significant way.

Electrification is Here to Stay

Despite the hurdles, the electrification of fleets, ranging from the consumer market to commercial markets like logistic trucks, is here to stay. As EVs become more available, options for EV charging have become increasingly common and faster than in the past, especially for options in public spaces.

Technology advancements have made it possible for EV owners to charge at home as well, ranging from plug-in chargers, or futuristic options like no-plug charging areas in parking spaces, which is still going through development by Taiwanese suppliers.

Electrification introduces several difficulties, including the urgent need to upgrade existing infrastructure and implement safety measures to accommodate various types of EV charging at home. But these new trends will open up new opportunities, as it introduces the possibilities of vehicle-to-grid (V2G), in which power flows back from EVs to power up homes.